Don’t Lose Your Lunch Over Market Moves

Since 2000, the S&P 500 Index (not including dividends) has experienced six annual jumps of at least 20% and five annual declines of at least 10%.

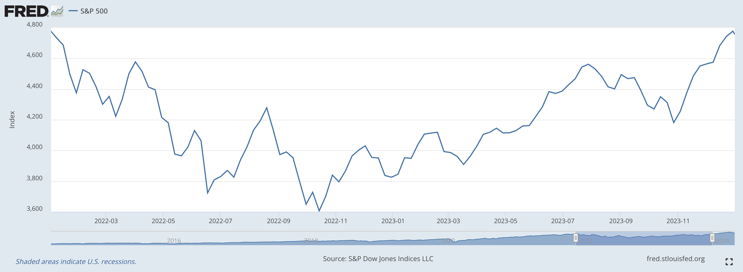

More immediately, the large cap benchmark plunged 19.4% in 2022 and leapt 24.2% in 2023.

That’s a 43.6% swing that meant S&P 500 Index investors ended 2023 at essentially the same spot where they started 2022.

But the week-to-week machinations weren’t that simple: Promising upswings gave way to sharp downturns and painful declines morphed into relief rallies.

S&P 500 Index Weekly Close 1/1/22-12/31/23

Source: S&P Dow Jones Indices LLC via Federal Reserve bank of St. Louis, https://fred.stlouisfed.org/series/SP500

Of course, there’s no such thing as a straight line in financial markets, but an investor’s ability to ride out the action has a lot to do with risk tolerance. And in 2022, we believe there were a lot of very nervous investors as the two-year road to flat returns was a roller coaster ride along the way.

Quantifying the Thrill

Here’s one of the interesting things about roller coasters: They may start and end at the same place. So, after you do the whole thing, you come back in and you look at the person getting on and they’re looking at you to see how it was.

What if, instead of flashing a smile or looking queasy, you could measure your happiness or enjoyment in percent terms?

If you had a really fun time on a roller coaster, you added 5% to 10%. So, it was a gain.

If you didn't have a fun time, you lost 5% to 10%. So, you finished the ride on a down note.

In the markets, most investors aren’t fans of roller coaster rides. They want as smooth and steady of a ride as possible.

Flashing back to the third and fourth quarters of 2022, we had strayed far from smooth as steady. The way markets had plunged, and interest rates were ratcheting higher, people were very nervous about the market’s future path.

Given those realities, it’s fair to ask how many people stayed invested through those discouraging times. With hindsight, it's easy to look backwards and say, “Oh, you'll be fine because we're going to rip up 25% next year, and all will be well.”

But in the moment?

Our goal is to provide the same percentage of happiness—or return—that the market will give you but with significantly fewer hills. By tempering the dramatic moves, our hedging strategy allows you to experience a similar outcome without being scared out of your seat.

Especially Salient for PE Investors

We believe the unpredictability of the public markets—notably, the fear that a big drop in equities is just around the corner—is a significant factor in the current rise of private equity and private lending.

In our opinion, private capital is the hottest area in the market right now.

We get it. We understand the thinking that it’s a space where you can go, find inefficient markets, extract efficiency out of those markets, and get good returns. It is, however, a long-term investment cycle as you must be invested in a private equity firm that buys a company, replaces the management, turns it around, and then flips the company out.

There have been some great success stories in the private equity arena, and we believe people that invest in private equity are very sophisticated and very forward looking.

We know, however, that finding great private equity managers is challenging and takes time—time when dedicated capital can be a drag on returns if it’s not being invested effectively.

Ideally, an interim allocation will provide market-like returns while featuring less volatility and daily liquidity. For example, our strategy acts like a storage tank, easily accessible when that private equity opportunity comes at you hard and fast.

In other words, if that PE manager due diligence produces a thumbs up tomorrow, you’re ready to move.

An Avenue to Stay in the Market

We consider our approach as guardrails to client portfolios, helping keep the extreme ups and downs from negatively affecting the decision-making process, which too often leads to selling low and buying high.

Admittedly, there are some advisors and investors are willing to work through the extremes, which is fine.

Many, however, get nervous and reallocate at inopportune times. Seems like their logic is that they don’t want to get caught up in similar moves, so they go in a different direction.

And yet, participating in the market, in our opinion, is a long game—always has been, always will be.

Consider the 2022-23 time frame. From April 1, 2022, (the date of inception) through December 31, 2023, our MDP Low Volatility Fund returned 6.11% with about half the realized volatility of the S&P 500 Index, which returned 5.28%.

We Relish Our Role for Our Investors

Away from the raw numbers, how did our approach play out in 2022-23?

In 2022, with the market tumbling, it was lonely around here. Our investors had so many things going on that were going wrong elsewhere that our phone didn’t ring.

We were ready for the calls, but due to the transparency, performance, daily liquidity, and daily markings of the positions, there wasn’t a whole lot of mystery around where we were or what was going on.

In fact, we probably got more calls in 2023 when the market went straight up, and people would say, “well, now, you're underperforming.” Sure, but we run a hedged equity product so we’re going to underperform in buoyant markets.

Ultimately, we think part of the response (or lack thereof) in 2022 was a reflection of our clients’ knowledge. They’ve been educated so that they understand the product through challenging times and they understand the process that we go through.

And they know we’ll do what we say we’re going to do and be consistent in our approach. It seems simple, but people recognize when that happens and clients don't worry about the manager that's being consistent. They worry about the inconsistent one.

The recalcitrant child gets a lot more of the attention from the parent than the one that's on the straight and narrow, and we believe that’s parallel to our firm and how we navigate the market, no matter how dizzying the ride gets.

Our Co-Founders Dennis Davitt and Mike McCarty tackled a host of volatility topics in their Derivatives is a 10 Letter Word session. Listen to it now!

Performance Results 1,2

As of 12/31/2023

| 3 Month | YTD | 1 Yr | Since Inception (3/31/22) | |

|---|---|---|---|---|

| MDP Low Volatility Fund | 5.84 | 13.87 | 13.87 | 6.11 |

| S&P 500 | 11.24 | 24.11 | 24.11 | 5.28 |

As of 03/31/2024

| 3 Month | YTD | 1 Yr | Since Inception (3/31/22) | |

|---|---|---|---|---|

| MDP Low Volatility Fund | 5.89 | 5.89 | 15.26 | 12.37 |

| S&P 500 | 10.16 | 10.16 | 27.86 | 25.98 |

- Includes Dividends.

- Performance data quoted represents past performance.

The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor's shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call toll-free 833-914-3344.

MDPLX has an annual gross operating expense of 54.71% Millbank Dartmoor Portsmouth LLC, the Fund’s investment advisor (the “Advisor”), has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until May 31, 2024, so that the Total Annual Fund Operating Expenses does not exceed 1.25%.

Investors should carefully consider the investment objectives, risks and charges & expenses of the fund before investing. The prospectus contains this and other information about the fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling (833) 914-3344.

Millbank Dartmoor Portsmouth is not affiliated with Ultimus Fund Distributors, LLC, member FINRA SIPC.

Important Risk Information All investments involve risks, and the Fund cannot guarantee that it will achieve its investment objective. An investment in the Fund is not insured or guaranteed by any government agency. As with any fund investment, the Fund’s returns and share price will fluctuate, and you may lose money by investing in the Fund. Derivative Risk: The Fund will invest a percentage of its assets in derivatives, such as futures and options contracts. The use of such derivatives and the resulting high portfolio turn-over may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. The Fund may experience losses that exceed those experienced by funds that do not use futures contracts and options strategies. New Fund Risk: The Fund is newly formed and has no operating history as of the date of this Prospectus. Accordingly, investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategy or growing to an economically viable size. Non-Diversified Risk: The Fund is non-diversified and as a result, changes in the value of a single security may have significant effect on the Fund’s value. Volatility Risk: Volatility produces various adverse effects. In general, volatility tends to discourage the participation of small investors and reduce the participation of some professionals in the financial market. Although volatility provides the opportunity for significant profits it can also result in equally significant losses. Liquidity Risk: The value of a fund's shares, when redeemed, may be worth more or less than their original cost.

Both of the sentence below are promissory and must be removed or reworded.

Per Ultimus, because you mentioned performnance we are now required to add Standardized Performance end 3/31/2024. They said 1,5,10 and SI (I’m confirming annualized or cumulative). And we have to add a performance disclosure. We could try to just add at end as a foot note (would need though to use same size font I believe).